We work in an industry that has had its share of challenges since 2008, including massive disapproval from the general public and the persistent occupy movement. From 2008 until 2013 the financial industry went through a systemic crisis for five consecutive years and dragged the global economy along. During this crisis some thought it could be the end of global asset and wealth management. With hindsight this deep fear about the future of the industry might have been somewhat overstated.

Today the asset management industry still is the engine of financial intermediation, helping investors find profitable investment objects while at the same time helping bright entrepreneurs to find funding for their innovative ideas. With this in mind we wonder why some asset managers only highlight half of their added value. Looking at their websites, they often formulate their “raison d’être” like “we are here to help our clients to achieve their financial goals, delivering the best performance etc”. True, of course, but asset managers do much more than that.

Money makes the world go round

A key function of the industry is to provide funding for companies, governments and other institutions and providing capital for solving fundamental issues across the globe. Making fundamental contributions to global development, from infrastructure investments in China to renewable energy in Europe. We´re not arguing that all asset managers primarily want to make the economy more sustainable, but we see promising side-effects. So while generating and capitalising on good investment opportunities in search for yield for their clients, asset managers help to create jobs, way beyond their own industry. We´d like to think that with all its shortcomings the industry does help to create opportunities, with a relevant impact on the distribution of wealth across the globe.

Bring some of the sunshine to the world

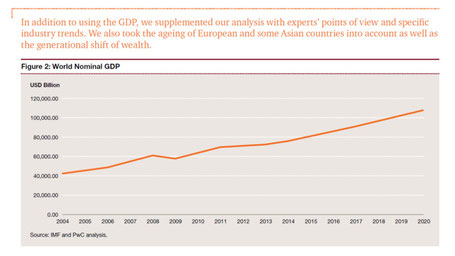

Now, almost 9 years after the start of the financial crisis, the future of the industry look promising. Surely there still are worrying trends on the shorter term, like excessive interventions of central banks, historically low interest rates and the proliferation of populist movements across the western world. Yet, overall the future of asset management once again looks bright with global asset under management expected to exceed 100 trillion USD by 2020. While passive is growing faster than active, even active asset management assets are expected to grow in absolute terms. Growth is what seems to be in the offing.

Now the question rises how the industry can forward these good tidings to investors. For the pension fund director looking for solutions to better match liabilities, the investor searching for yield and the entrepreneur looking for funding of his business the industry could direct more brainpower to crafting innovative solutions. Over the years the global financial industry has attracted some of the brightest and most creative souls, from Ivy League Universities across the globe. We believe in the creativity of the industry. Surely the global financial industry can be the engine of financial intermediation once again, helping investors to find profitable investment opportunities and helping entrepreneurs across the globe with funding for their innovative ideas.

To do so, asset managers will have to set their priorities straight and ask the key question, ‘Who are we doing this for?’. Only when that question is asked, we will regain our mojo.

See you in two weeks!

Vincent Hooplot & Michiel Breeschoten

Write a comment