For more than a decade very smart people across the globe working for the likes of BCG, Roland Berger, McKinsey and PwC have been promising the asset management industry a golden future. And indeed the investment management industry, also known as the asset management industry, is healthier than ever with 74 trillion US dollar assets under management and a growth rate of 8% in 2014. The profits of the industry are more or less back at the pre-crisis level. That said, not all asset managers grow at the same pace. Going through some of the most recent impressive industry reports is like listening to a steady and monotonous drumbeat, but what really puzzles us is this question: How is it possible that under the same circumstances some thrive and grow, while others settle for mediocre results and some even seem to be heading for bankruptcy amidst unhappy clients, shrinking market shares, hampering product development, while chasing profitability by cutting cost instead of developing new opportunities? Too often asset managers refer to investment performance as the only driver of success, but while it indeed is a key driver it still doesn’t sufficiently explain the difference between the winners and losers in our industry.

According to global research, differences in growth rates of investment managers are not merely caused by differences in investment performance. Simply put, there is no perfect correlation between investment performance and sales flows. So, there is definitely more to it. Nowadays asset managers face volatile market conditions, commoditization of their products, tech savvy challengers entering the already crowded market, massively changing buying and information seeking behavior of clients (both institutional and retail), a rapidly changing regulatory landscape, as well as changing demographics and the war for talent. Thus, growing and thriving in this challenging global environment requires more than superior investment performance. Mind you! There’s nothing wrong with superior investment performance, except the fact that it’s very hard to come by, especially consistently on a 3 to 5 year horizon.

So what is the secret of those that are disproportionally successful? Here are some observations from the work that we do with and for our clients: it is the excellence in finding, engaging and retaining both clients and talent - better, faster and smarter than the next guy, e.g. competitors. The most successful asset managers achieve this by focusing their resources and management attention on understanding and developing the aspects that drive their marketing effectiveness, sales force effectiveness, reputation and memorable customer experiences, as well as timely entries into new markets, new asset classes and product development. They outperform others by better tracking and understanding return on marketing & sales investments. In addition they actively use data for decision making and improved understanding of client needs. These managers have strong and distinctive brands and customer value propositions and, as a result capture a disproportionate share of net flows.

Less successful asset managers, on the other hand, often report a lack of progress in critical capabilities, including: customer and competitor insights, marketing spend & productivity tracking, innovation and product development. They fail to look at the competitive landscape in a consistent manner, to gather relevant data and to implement data driven decision making.

Boosted by new technology and clients going digital, a wealth of data is available, both within asset management companies themselves and from external sources. If the data is out there or, should we say, in there but many asset managers lack capabilities for interpreting and actioning customer and competitor insights and marketing spend and productivity tracking, clearly their data gathering, metrics and data interpretation processes are underdeveloped.

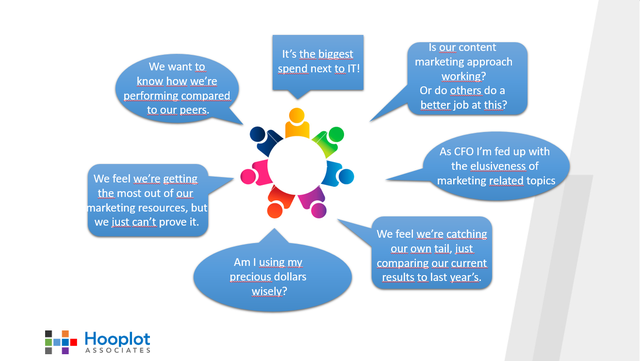

In our daily interaction with asset managers we come across the best practices as well as those with the opportunity to improve. In many of these discussions we learn that asset managers often are struggling with the same issues, such as the ones presented in the figure below.

We see stars, but also median performers and the laggards, completely in line with our research findings and the findings from BCG, Roland Berger and others. Many years of studying the marketing effectiveness of small, mid-sized and large asset management firms has led to the insight that the most successful companies have three things in common when it comes to their marketing effectiveness:

- They create a cadence of accountability and relevant metrics. "If you can't measure something you can't improve it. Or at least one cannot verify progress made."

- They are very aware of their surroundings and build their plans and activities to leverage gained insights. Research about clients, competitors, propositions and regulatory changes are embedded in strategic decision making.

- They create a clear sense of purpose, align systems and unleash talent. They also commit to attracting and retaining top talent.

Are you an asset management marketer, CMO or in any way responsible for the batting average of your firm and wonder whether you should up your marketing game? If the answer is yes, you should probably start with understanding your own marketing effectiveness. Knowing whether you should up your game is a relative trade and requires competitive data and insights. If you don’t benchmark your effectiveness today, you will not know where you stand. So the question is, is it time to up your game? Or time to up your game!

Vincent Hooplot & Michiel Breeschoten

Write a comment